"Is it safe to invest in mutual funds ?" I hear this question a lot now a days, And It has to be because mutual funds are the new talk of the town.

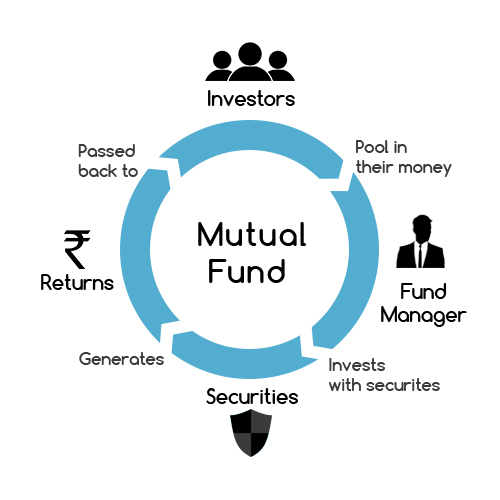

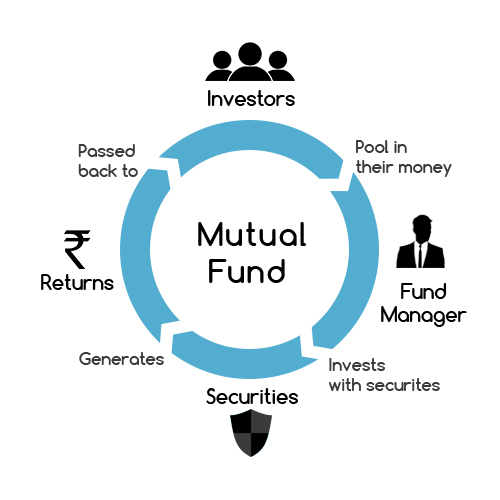

But the reality is many people don't know what actually is mutual funds so, here is a beginners guide to understand mutual funds.

But the reality is many people don't know what actually is mutual funds so, here is a beginners guide to understand mutual funds.

Why people investing in mutual funds?

Sure, the markets are down. So are equity mutual funds. However, many investors are still getting into mutual funds because of the higher historical returns. Be careful. It is true that equity mutual funds can offer higher returns than other asset classes over a long period. However, as you can see, they can be volatile in the short term. They can also offer negative returns in a short period.

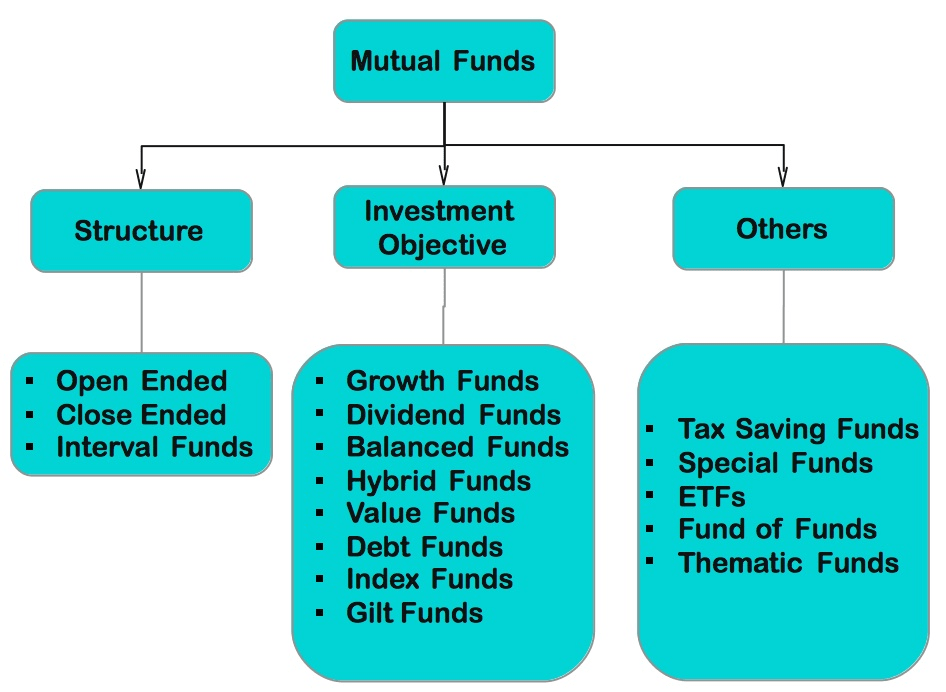

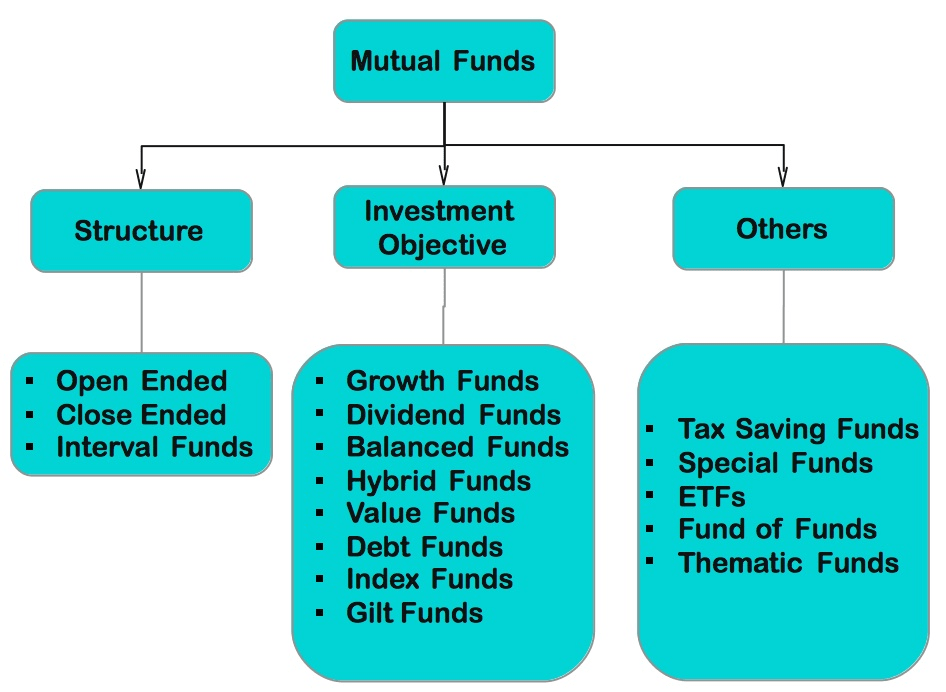

All mutual funds do not invest in stocks

Apart from equity mutual funds that invest in stocks, there are debt mutual funds that invest in debt instruments or fixed income securities. There are also hybrid schemes that invest in a combination of debt and equity. Then there are gold funds that invest in gold, sector or thematic schemes dedicated to a sector or theme, international schemes that invest abroad.

How to choose a scheme?

Definitely not on its star rating or past returns. You should always choose a mutual fund scheme based on your goals, time in hand to achieve the goals, and your risk profile. For example, if you want to invest for a short period, you cannot afford any risk. That is why you should park the money in a fixed deposit or debt mutual fund scheme. If you want to invest for a long period, you can afford to take a little risk. This is because even if the investment is hit by a rough patch in the market, you can recoup your losses over a long period. That is the reason why equity mutual funds are recommended to meet long-term goals.

It is not that simple

There are many kinds of equity and debt schemes. It is extremely crucial to choose a debt scheme that matches your investment horizon. For example, you cannot invest in a long duration scheme when you have an investment horizon of a few months. An ultra short duration scheme is suitable to park money for a few months. A short duration scheme, on the other, would be ideal to park money for a few years. Similarly, a large cap schemes is less riskier than multi cap scheme. That is why large cap schemes are considered suitable for conservative equity investors, whereas moderate equity investors should choose multi cap schemes. Aggressive investors may opt for mid cap and small cap schemes.

Does that sound simple?

If yes, you may proceed. Otherwise, you should consult a mutual fund adviser. Many investors do not like to hear this. But we believe investing directly is meant for investors with sound knowledge about investing in mutual funds. Others should go through an adviser. Many investors lose their nerve during tough times in the market. They stop or abandon their investments during the phase. Some hand holding and guidance from a mutual fund advisor can help to avoid such situations.

No comments:

Post a Comment